buy now owe later

If you’ve shopped online recently, you may have noticed an extra checkout button offering installment payments. Installment Payments, known in industry as “Buy Now Pay Later” (BNPL) schemes, are enjoying rapid consumer uptake and generating massive investment. They will soon be everywhere - installments are projected to account for ~15-20% of all retail purchases by 2025. In spite of recent excitement though, it looks as though this party may be over before it really begins.

installments?

BNPL schemes are the type of innovation which is so obvious you wonder why it didn’t exist already. Essentially, they enable consumers to easily pay for anything with a fixed number of installment payments - typically four to six - with 0% interest (e.g. a $100 purchase is paid over four $25 payments), and immediately receive the good or service. Ubiquitous in Australia and several European countries, BNPL is rapidly spreading across retailers worldwide:

New bike? Pay with installments.

Cosmetics? Pay with installments.

Groceries? Pay with installments.

Why care? Customers who would otherwise abandon their purchase choose to check out with a BNPL installment plan when given the option. Furthermore, these customers are more likely to spend more (up to 85%!), and repeatedly. In other words, installment schemes stimulate incremental revenue to retailers of every stripe.

The installments themselves aren’t new, but how they’re offered. BNPL schemes use very limited customer-input information at the time of sale to make an instant credit decision. This relatively frictionless consumer experience allows them to sit within the checkout flow both in-person and online. A consumer wavering on the $500 lump sum price may see the offered installment plan and decide $125 payments spread over the next four months is palatable, winning the sale. A good analogy is that BNPL installments are to merchants as credit cards for consumers. They expand ‘selling power’ beyond what is otherwise capable, all through the power of creative finance.

Data back these claims, and installments are taking retail by storm. Dozens of BNPL startups have emerged to meet this demand, offering merchants variations on this core premise. To consumers, the pitch is relatively constant: “split up your transaction into multiple payments, with no fees or interest, and start enjoying your purchase today.”

The pitch works, particularly among millennials. Coming of age during the great recession and saddled with historic loads of student loan debt, millennials are wary of credit, preferring cash and debit cards. (Gen Z less so). BNPL is a perfect match for these financially-conservative consumers. First, low payments are more psychologically attractive than a lump sum. Second, BNPL allows debit-exclusive cardholders to make larger-than-otherwise purchases from their primary checking account [1]. Third, BNPL appeals to impulse buyers by allowing them to enjoy their purchase immediately, rather than build over time towards receiving a purchase (and allowing time for reconsideration). Fourth, and finally, BNPL is seen as a means to ‘manage’ finances by unlocking greater near-term liquidity. For their part, BNPL providers market aggressively to these perceptions - consider one vendor’s language: “split anything into 4, small, ‘lil payments, made every 2 weeks. No catch, no credit impact—just flexibility.”

The problem is that there is a catch.

Figure 1: Afterpay’s pitch to potential merchant customers, describing their target demographic. Screenshot taken from Afterpay website, February 4, 2020.

Figure 1: Afterpay’s pitch to potential merchant customers, describing their target demographic. Screenshot taken from Afterpay website, February 4, 2020.

unsecured debt, all the way down

The concept of buying now and paying later is an old familiar one, commonly known as ‘loans’ or ‘credit’. Behind the slick interfaces, BNPL schemes simply hawk immediate low-value loans (typically below $10,000). As mentioned earlier, their innovation lies in offering the loans quickly at the time of sale. This presentment is so convenient that consumers have no time to think - and basically impulse buy what they otherwise couldn’t or wouldn’t!

Whiles this is great for retailers, it isn’t necessarily so for consumers. BNPL users have 0% interest and no fees provided they make their payments on time. Penalties include high interest on missed payments (up to 30%), fixed late fees, and dings to their credit scores. Similar to traditional loans and credit cards, consumers spending beyond their means face drowning in a BNPL debt.

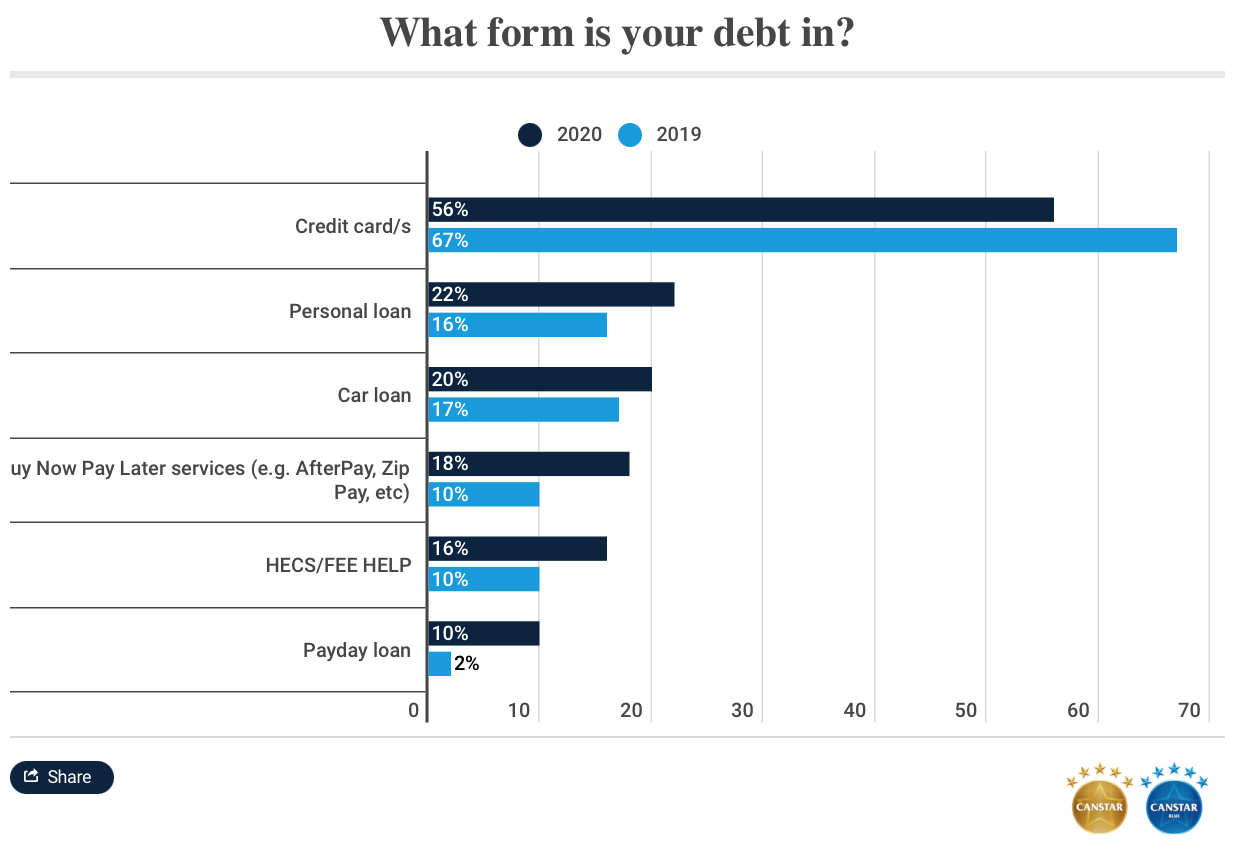

This is no hyperbole. In the BNPL-saturated Australian market, nearly 18% of surveyed consumers were indebted to BNPL schemes in 2020, up from 10% in 2019. The majority of BNPL users (and late payers) are under the age of 35, meaning poor financial decisions are more likely to echo throughout lifetimes.

Figure 2: Surveyed Australian’s forms of debt. Source.

Figure 2: Surveyed Australian’s forms of debt. Source.

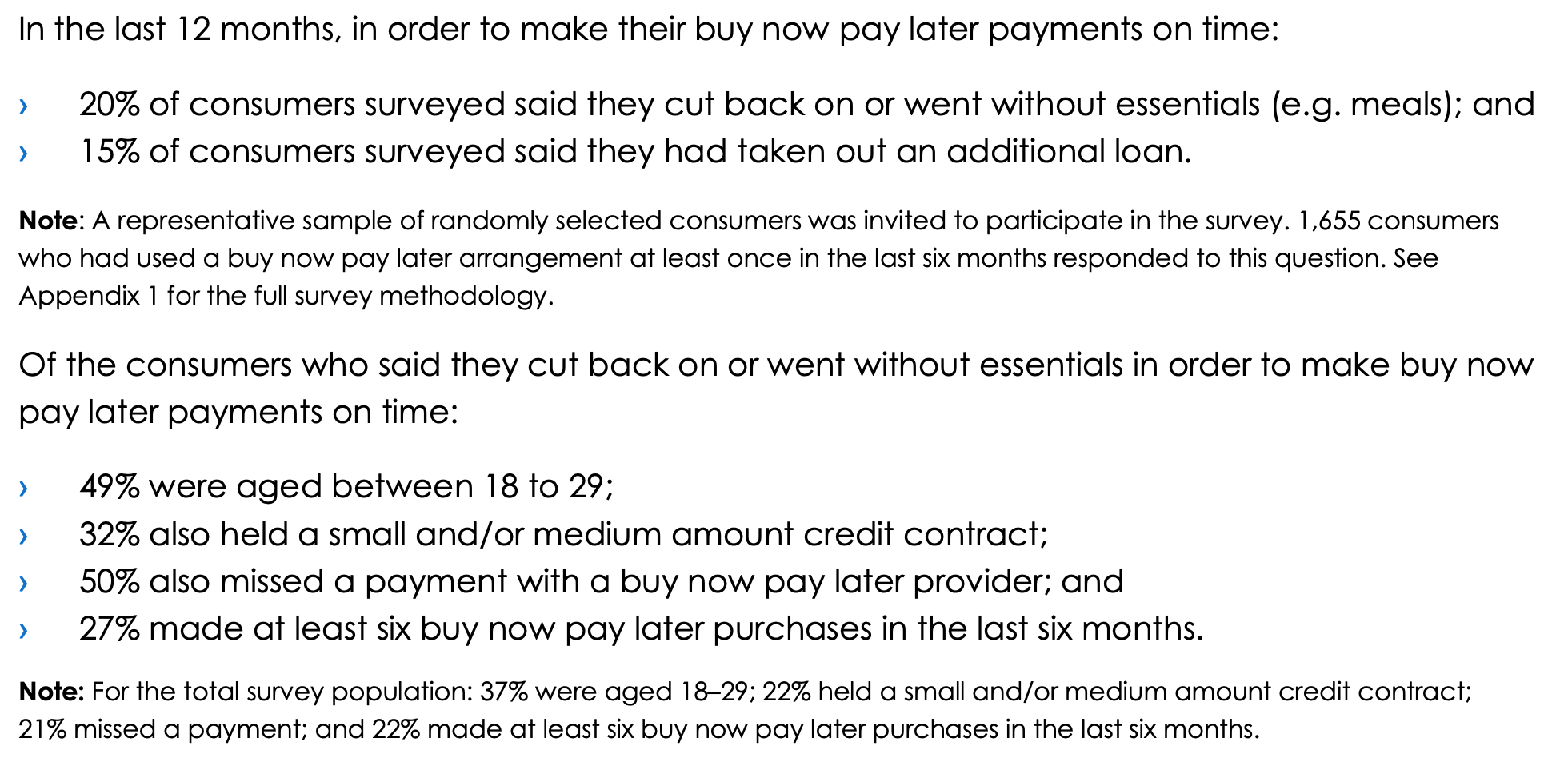

Already the outcomes are bleak - the results of a November 2020 Australian government study speak for themselves:

Figure 3: Surveyed Australian’s BNPL consequences. Source.

Figure 3: Surveyed Australian’s BNPL consequences. Source.

What else would one expect from an unregulated, small-loans product with high fees and interest rates aggressively marketed to young adults? The service enables consumers to easily magnify their purchasing power with unsecured loans - of course the service is popular! It may not be explicit or even intentional, but BNPL startups are in a race to grow as quickly as possible before regulators can catch up.

To be fair - the majority of BNPL firms don’t subsist on fining struggling customers. Like any business, repeat customers are the best customers. Instead BNPL schemes tend to earn a majority of revenues from merchants by taking a fixed fee plus a percentage cut on every successful sale. Their pitch to business owners is simple - without them, the sale wouldn’t have closed. If this pricing looks familiar, its the same model (and business case) used for credit cards.

Only recently has anyone started asking if these sales should have occurred in the first place. Regulatory bodies have begun studying the industry in order to form policy guidance. In fact, while drafting this essay the U.K. Treasury announced BNPL schemes would come under the authority of the regulatory Financial Conduct Authority and face increasing regulation. Other countries are likely to soon take the U.K.’s lead.

And for once, legacy players get to enjoy a deep sigh of relief from regulatory intervention. BNPL schemes steal not only would-be loans from traditional banks but also transaction interchange from payment card revenues. Their rapid growth poses a major threat to banks struggling to attract credit-card-shy millennials, and regulation provides welcome breathing room to adapt.

Regardless of regulation, BNPL schemes are here to stay and promise to fundamentally disrupt how consumers pay. It is easy to imagine BNPL taken to the extreme with various new innovations in finance. BNPL combined with Real Time Payments could allow consumers to pay for purchases as they’re consumed or used, or BNPL combined with ‘smart’ personal finance software could automatically take out loans as needed without ongoing consumer consent. Alternatively, BNPL providers may diversify and offer a more consumer-friendly predecessor - layaway purchases, or allowing consumers to only receive a good or service after it has been paid in full via installments. While far less slick, perhaps the future of “Buy Now Pay Later” is sharing its pedestal with “Pay Over Time and Receive Later”.

BNPL’s rapid growth will likely soon end in favor of the incremental change typical of financial services. This is good, as they promise to dramatically expand our concept of loans in the long run, and our society needs time to adapt. Loans have been recognized dangerous and regulated as such since the days of Hammurabi. Until BNPL schemes gain stricter oversight, it may be best to rethink that impulse buy.

I welcome your feedback. Please don’t hesitate to reach out through the contact section of the website if you would like to discuss, comment, or have any suggested edits.

[1] Yes, I’m aware some services like SplitIt place payments exclusively on credit cards.