saving correspondent banking

Banking used to be tough work. Not just long hours and rows of numbers, but complex, physical labor. Currency needed ferrying across oceans, identities verification, and records transcription. As participants multiplied and distances spread, this burden only grew. Modern digitization has suddenly reversed this trend, eliminating much of this labor. Now exposed and implemented at scale, many of banking’s architectural flaws have grown too obvious to ignore.

One of the most striking examples is Correspondent Banking, which enables international finance yet also incalculable volumes of financial crime. Over the past decade its drawbacks have finally overshadowed the system’s benefits, causing a seemingly irreversible decline. This is a problem. Despite its flaws, Correspondent Banking has democratized international trade by enabling cross-financial flows to open and flourish the world over. Its decline and ultimate relegation threatens less financial independence for businesses and long term growth prospects for emerging markets.

To help preserve this venerable system, I propose an evolution of Correspondent Banking, unlocking efficiency while simultaneously eliminating a notorious channel for illegal money movements.

correspondent what?

The point of Correspondent Banking is to allow one bank to provide routine banking services to its customers through another bank, regardless of the original customer’s physical or regulatory location. Today this system is massive - facilitating over USD $150 Trillion per year internationally. The majority of this volume stems from business-to-business (B2B) payments while smaller use cases include remittances and consumer ecommerce. The uncertainty and extra attention applied to cross border interactions also means Correspondent Banking garners higher fees, making it highly profitable for bank providers when conducted at scale. Our world today could not function without Correspondent Banking.

This modern juggernaut has ancient beginnings. In 16th century Europe this was fantastic – a merchant could travel from one fiefdom to another and conduct business while leveraging their assets back home. The implications were immense: physical specie didn’t have to be carried, which promoted use of cheques and banknotes. Periodic balance resets of the underlying debits and credits between partner banks led to standardized processes for calculating and physically exchanging balances – the origin of today’s ‘clearing’ and ‘settlement’ practices.[1] As these networks scaled and standardization needs increased, formal ‘clearing houses’ emerged, which naturally concentrated financial power and led to governments being able to establish greater control over financial systems in the form of central banks.

Today Correspondent Banking has diminished in importance but nevertheless continues to play a key role in the modern financial system. While its use cases have changed, its core premise remains the same – enabling one bank to provide financial services to its customers through another.

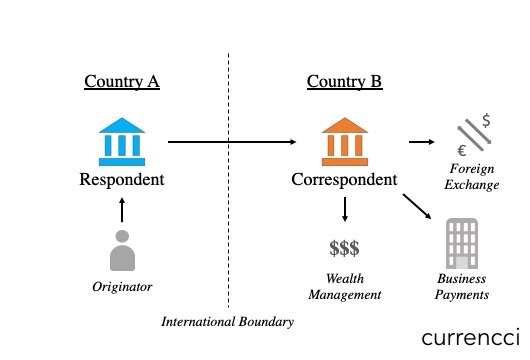

The process is simple. A ‘Respondent’ bank opens an account at a ‘Correspondent’ bank and requests the Correspondent perform actions using the funds in Respondent’s account on behalf of the Respondent’s customers. Respondents and their customers may be provided with an array of services in the Correspondent’s jurisdiction, including cash management, local and wire transfers, check clearing services, payable-through accounts, and foreign exchange services.

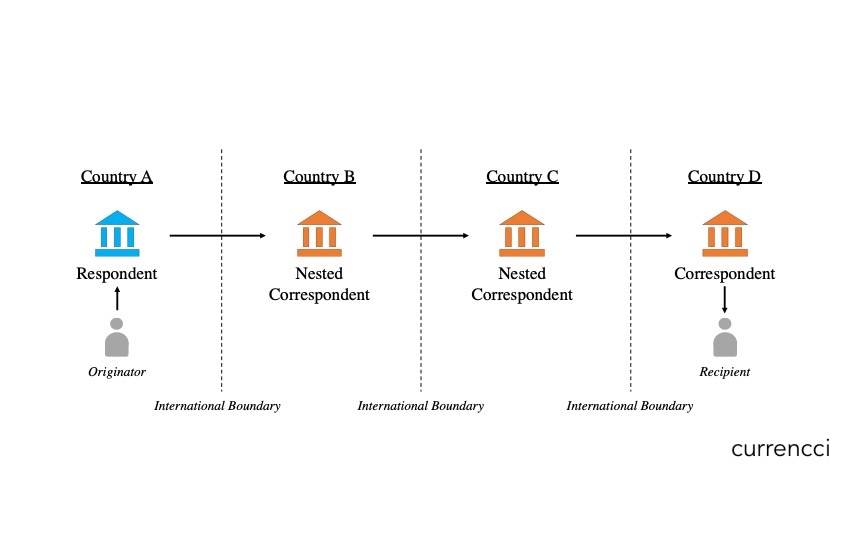

Going back to the 16th century - as inter-regional trade grew, individual banks couldn’t possibly offer branches everywhere. Instead, Correspondent Banking filled this gap. What’s more, as inter-regional trade turned inter-national a more sophisticated network developed wherein international relationships became ‘corridors’ and the bank participants in each were labeled ‘active Correspondents’. With the growing complexity, even the most sophisticated banks couldn’t manage a relationship with every potential partner. Instead, a ‘nested’ Correspondent system organically developed, wherein a Respondent would use a daisy-chain of Correspondents to serve its customers.

Going back to the 16th century - as inter-regional trade grew, individual banks couldn’t possibly offer branches everywhere. Instead, Correspondent Banking filled this gap. What’s more, as inter-regional trade turned inter-national a more sophisticated network developed wherein international relationships became ‘corridors’ and the bank participants in each were labeled ‘active Correspondents’. With the growing complexity, even the most sophisticated banks couldn’t manage a relationship with every potential partner. Instead, a ‘nested’ Correspondent system organically developed, wherein a Respondent would use a daisy-chain of Correspondents to serve its customers.

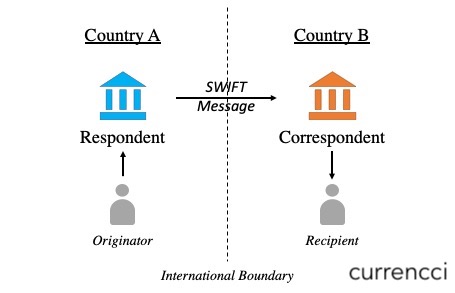

Digital efficiencies in the past several decades have brought another wave of standardization to this network, which led to a first wave of industry contraction. First, starting in the 1970’s, banks began adopting the international banking communication system SWIFT (Society for Worldwide Interbank Financial Telecommunication) which enabled direct relationships between remote partners. Further, a spate of mergers in the late ‘90s and 00’s led to a class of ‘ultra-banks’ with large international footprints. Up until 2001, this led to a steady, gradual decline in the network’s overall complexity.

This gentle decline turned rapid descent with the 9/11 terrorist attacks. A harsh regulatory spotlight fell upon the Correspondent Banking network, and legislators were shocked at what they found.

so what’s the problem?

Correspondent Banking’s negative byproducts cannot be understated. It has and continues to be a major enabler of illicit financial activity through the obfuscation it provides, most infamously leveraged for sanctions avoidance and money laundering.

Correspondent Banking’s original sin is that it opens an unguarded backdoor to the global financial system, providing easy access for sanctioned individuals or entities (e.g. terrorists, known criminal organizations, etc.) as well as illicit funds. The mechanism is simple: Correspondent banks have historically relied solely on the compliance processes of their Respondents, and thus malevolent actors interact with those Respondents with the weakest controls in the weakest jurisdictions. Lax compliance standards at targeted banks are exploited to open accounts and deposit funds under names (or aliases) and amounts which would otherwise be triggered at more sophisticated financial institutions. Thus, bad actors have free reign in leveraging Correspondent privileges in more regulated markets. While this commonly abused tactic has been hampered somewhat thanks to increasing international regulation and collaboration, preventative measures are only as effective as those implemented by the weakest link.

Correspondent Banking also effectively breaks the ‘provenance’ of funds, rendering fund tracking by compliance and regulatory agencies nearly impossible. Proactive tracing of monies transferred from an account at a Respondent, through to a Correspondent, and to a separate account within the Correspondent country requires configuration of multiple data feeds. In most instances this is simply not performed, and in practice is further complicated through nested Correspondent relationships, wherein funds are transferred through layers of Correspondents, or Correspondents in jurisdictions with stringent bank secrecy laws. As such, fund tracking in such circumstances must be conducted manually. If even reached, conclusions are often moot - by the time investigators have resolved logistical and legal issues, records are out of date (if they still exist at all) and the funds have long since been successfully laundered.

The risk of these backdoors cannot be understated - in 2016 $822 billion was facilitated daily by correspondent banking, just within the Eurozone. The IMF estimates 2.7% of Global GDV is laundered annually, totally $1.6 Trillion dollars in illicit funds. By definition the amount of black funds facilitated by correspondent banking is unknown, but it is surely large. The startling frequency over the past decade major banks have received billion plus fines for enabling illicit activity through their correspondent banking operations only confirms this criminal activity continues.

Unfortunately the criminal behavior abetted by Correspondent Banking is unlikely to be resolved through existing mechanisms. Regulatory agencies and legislators are hamstrung by the international nature of the process - laws and enforcement can be championed, but never fully enacted in a standardized manner. While a universal regulatory framework for Correspondent Banking is an admirable goal, it does not appear realistic. Industry-led standards and best practices are similarly unattractive - enforcement across jurisdictions is again the issue.

Aside from these more substantial societal issues, Correspondent Banking today generally business unfriendly. Completion of a payment takes days, is expensive, and may involve manual review. Data fields aren’t always populated correctly, and character sets limited to major languages. Modern ‘quality of life’ upgrades are sorely needed across the technology to make it more suited to today’s environment.

gently into the night?

Starting in 2001 and accelerating the past decade, the number of banks participating in Correspondent Banking has shrunk due to an increased awareness and regulatory scrutiny of these negative byproducts. Banks in more developed markets simply don’t see enough return for the cost and risk of abetting illegal activity through their Correspondents in emerging ones. The result has been a drastic decline in Correspondent Banking relationships, with a ~20% decline observed from 2010 to 2020.

The decline of these international relationships is remarkably incongruous with rising globalization. In fact use of Correspondent Banking for international payments and business messages has risen more than 20% since 2011 as corridors have closed. Concentrating volumes across fewer bank participants leads to a vicious cycle of stifling growth. As the number of corridors decrease to a given market, the cost of cross border payments increase. Higher costs drive end-users to alternatives which are less, or even fully unregulated, and lack the digital, risk, and legal protections of financial institutions. This in turn erodes the market’s financial integrity, raising costs and lowering incentives for smaller banks - particularly those in developing markets - to maintain Correspondent relationships, stifling those economies.

Correspondent Banking as it exists today is obsolete. It is expensive, enables illicit activity, and is generally unfit for modern finance all at a time when the core service it provides - international payment corridors - is reaching all-time levels of demand. A new paradigm is sorely needed.

let there be light

“Sunlight is said to be the best of disinfectants; electric light the most efficient policeman.” – Louis Brandeis in “Other People’s Money and How the Bankers Use It”

Legitimacy arises from the truth of transparency. The successor to Correspondent Banking must offer clarity rather than opacity, advance preventative and punitive measures rather than hinder them, and adhere to regulations rather than become entangled. To succeed, the replacement must be easy to implement, operate, and audit all while providing cheap and reliable cross-jurisdictional financial services. Consolidating these needs leaves a minimum set of requirements for Correspondent Banking’s replacement:

-

Comprehensive Provenance: All facilitated payments should have a thorough chain of custody log, detailing every step and relevant attribute. Advances in processing power, connectivity, and storage make doing so trivial today.

-

Transparent Privacy: The solution must offer easy traceability of payments between and through accounts at different financial institutions, across jurisdictions, all while retaining financial privacy. No solution like this has been put into market at scale as of writing, though some variants of blockchain have claimed to solve for this seeming oxymoron.

-

Standardized KYC: A major issue facing existing systems is the variability in compliance quality between international financial institutions. The replacement to Correspondent Banking must eliminate this loophole by forcing a common standard of due diligence amongst all participants. While payment provenance and transparency would solve for money laundering, a common procedure for Know Your Customer (KYC) compliance is necessary. Such a system would mandate all participants in the network to perform the same rigor of KYC on their customers prior to giving them access to the broader international network. The boom of KYC fintechs has resulted in a wave of innovations and standards in this field which could be leveraged to build such a solution.

-

Multilingual: Correspondent Banking’s replacement must be able to facilitate real-time communication between international participants. Modern standards like ISO20022 are gaining momentum, but a universal payments language is nowhere close to ubiquity. Rather than achieve this monumental task, the solution must instead be able to flawlessly operate across relevant standards. An industry has emerged to offer such functionality, including the major players Plaid and Finicity, which were recently acquired by the payment networks Visa and Mastercard, respectively.

-

Audit-ability: The replacement must aid regulators by offering simple auditing and reporting. ‘Meta-auditing’ capabilities should ensure enforcement occurs in a lawful and non-abusive manner. Such functionality appears feasible using current technologies.

Though the requirements may be straightforward, their assembly is anything but. In addition to possessing the above requirements, the system to replace Correspondent Banking must balance the stricter compliance arising from centralization with the privacy and innovation of a fragmented, competitive market. Most of all, it must offer distinct advantage to banks, businesses, and consumers currently relying upon Correspondent Banking for legitimate purposes.

The technical building blocks for the replacement are ready. Off-the-shelf technologies for digital identity, standards, storage, throughput, and security are all advanced enough to support a ubiquitous international network. Further, a digital format suggests a low cost and scalable solution. The main challenge in building a successor to Correspondent Banking lies in solving the regulatory and business challenges of shifting incumbents’ behavior.

emerging alternatives

Correspondent Banking’s weaknesses paired with its massive market size has attracted many attempts to build its next iteration. None appear to fully meet the above requirements, yet two stand out as strong contenders as becoming the next dominant international network in a ‘winner takes all’ environment.

The first serious contender for replacing Correspondent Banking is ‘SWIFT gpi’ (“global payments initiative”). In an effort to preserve its market dominance the SWIFT organization built SWIFT gpi as a natural upgrade for existing Correspondent Banking customers. Its major features include drastically reducing the time from payment initiation to completion, fee transparency, and traceability for each message. Further, SWIFT gpi takes advantage of ISO20022 to standardize and enrich remittance information. SWIFT’s status has allowed the platform to gain dominant market share. In 2019 SWIFT gpi processed over $77 Trillion in cross border payments, or 65% of all messages sent over the SWIFT (i.e. Correspondent Banking) network. SWIFT gpi is now expanding to lower value consumer cross-border payments and allowing banks to compete with non-bank providers who have moved into this space. This will not only lower fees for end-users, but also ensure regulators can better monitor these cross-border corridors.

The other significant contender is RTGS Global. RTGS Global is built from the ground up to facilitate instant international transfers between various Real Time Payment networks, a novel payments channel enabling immediate funds transfer accompanied by reams of contextual data (for more, please see the series on Real Time Payments. Unencumbered like SWIFT gpi by legacy processes or thinking, RTGS Global’s fresh architecture expands the range of Correspondent Banking relationships and interactions. Just as important, RTGS Global promises a legitimate alternative to SWIFT’s Correspondent Banking solutions and thus lowers the global economy’s international risk against this single point of failure. However, RTGS Global’s promise is just that - the network is still nascent and yet proven as a viable network.

Though these two systems are impressive, neither fulfills all the requirements set forth above for the ‘ideal’ Correspondent Banking replacement. Mainly, these new systems optimize performance of the existing Correspondent Banking model rather than introducing a new one outright. Most notable is the failure to address the historic regulatory challenges which come with international payments.

the currencci model

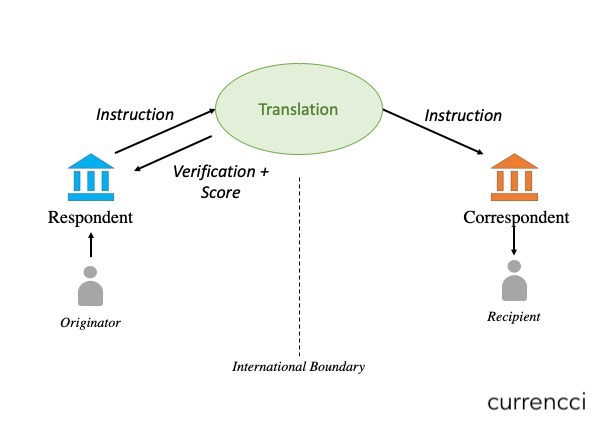

To replace Correspondent Banking, I propose introducing a common mechanism for banks to independently de-risk both domestic and international bank-to-bank relationships. At a high level, this mechanism would effectively provide a meta-KYC for banks themselves. If a bank can be trusted, then why not extend at least a portion of that trust to its customers?

As does everything, trust consists of shades of gray. A perfect KYC system - and sharing consumer’s private information internationally - is as unrealistic as the current standard of simply trusting all correspondent banks the same. Instead, the proposed solution will enable banks to make informed decisions about their trading partners while presenting their own compliance abilities transparently.

The solution would work as follows: participating institutions would be evaluated upon onboarding, similar to the KYC process for consumers, and a basic score assigned. Next, payments and services flowing from participating Respondents would be translated to both a universal standard as well as the Correspondent’s standard, evaluated in a dynamic manner, and assigned risk scores relevant to the Correspondent’s jurisdiction. Both missing information and positive indicators would be highlighted, enabling Respondents to make informed decisions about potential Correspondents and their respective customers.

Privacy is paramount in banking, which is why the scoring and information sharing would be voluntary. Aspiring Correspondents would elect on what information to share to other participants on the network. Of course, those who shared more on themselves - particularly in key areas such as rigor of validating KYC - would garner higher marks than those who didn’t. Such is fair.

Why would this work? Global finance is inherently decentralized, making a centralized solution unrealistic - banking will never follow a universal proprietary standard or regulation. Rather, the proposed would possess low entry requirements paired with allowing a range of participation. The gradient belies a slippery slope, beneficial to the network. The ability to share more information to gain a competitive edge within the market would incentivize participants to gradually share more and more information to become preferred partners. Hold outs could claim prioritizing customer privacy, but those institutions would also bear the dubious lowest ratings on the network. In an ironic twist, Correspondent Banking relationships would become a mechanism for highlighting high-risk elements of the ecosystem rather than obscuring them.

Such a model has obvious weaknesses - notably the feasibility of the proposed initial evaluation and the willingness of financial institutions to undergo objective risk scoring. Regardless, risk reduction for players in stricter markets is a key piece of the puzzle and must be resolved with any successful solution.

Correspondent Banking emerged to connect far-flung cultures and thrived in spite of its massive logistical challenges. Modern technology has rendered these logistical issues moot, yet the interconnectedness of international commerce is at risk because of an inability to reconcile cross-jurisdictional requirements. An open and close-knit global financial network is in the interests of everyone. It would be a shame to let this valuable service fade without a fight.

I welcome your feedback. Please don’t hesitate to reach out through the contact section of the website if you would like to discuss, comment, or have any suggested edits.

[1] The source of this history, and an excellent brief of European banking is located here.